Why is the maintenance increasing in June?

The current board voted to increase the maintenance because without it, budget projections predict an operating deficit of roughly $350,000 by the end of 2025.

A maintenance increase of 18% is calculated to substantially reduce, and likely prevent, this deficit. The board is also working on cost-cutting measures.

To calculate the increase in your monthly maintenance, multiply your current maintenance by 0.18.

Example:

$712 (current monthly maintenance) × 0.18 (maintenance increase) = $128.16 extra per month.

Why is the June maintenance increase so large?

The increase needed to prevent an operating deficit is large this year because the cooperative failed to act sooner, when small annual increases would have kept the budget balanced.

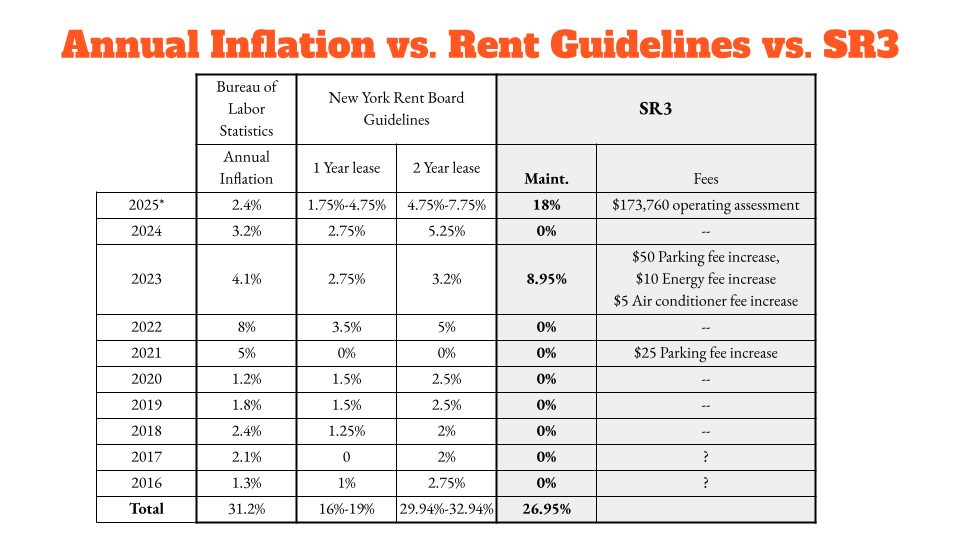

The cooperative’s maintenance has only increased once since 2015, while inflation has averaged 2.4% annually during the same period (see U.S. Bureau of Labor Statistics). In other words, for ten years the cooperative’s income has largely remained the same, while its costs have generally increased about $85,000 each year.

Additionally, the age of the building and the New York City market have supercharged cost increases since the pandemic. According to Habitat, a magazine published for New York City co-op boards, costs for New York City cooperatives have increased at three times the inflation rate for the past few years, with contributing factors such as Local Law 97, Local Law 126, and soaring utility costs.

The table below shows a comparison of U.S. inflation rates over a ten-year period with rent increases approved by the New York City Rent Guidelines Board (RGB) and the cooperative’s own maintenance increases during the same time. Inflation reflects the rising costs faced by the cooperative, while the RGB increases illustrate how maintenance could have been raised more gradually—had the board acted sooner.

In future years, the current directors aim to make more frequent, smaller increases to keep up with inflation, while also looking to cut costs where possible, to prevent additional large maintenance hikes.

Why can’t the cooperative increase the maintenance more slowly?

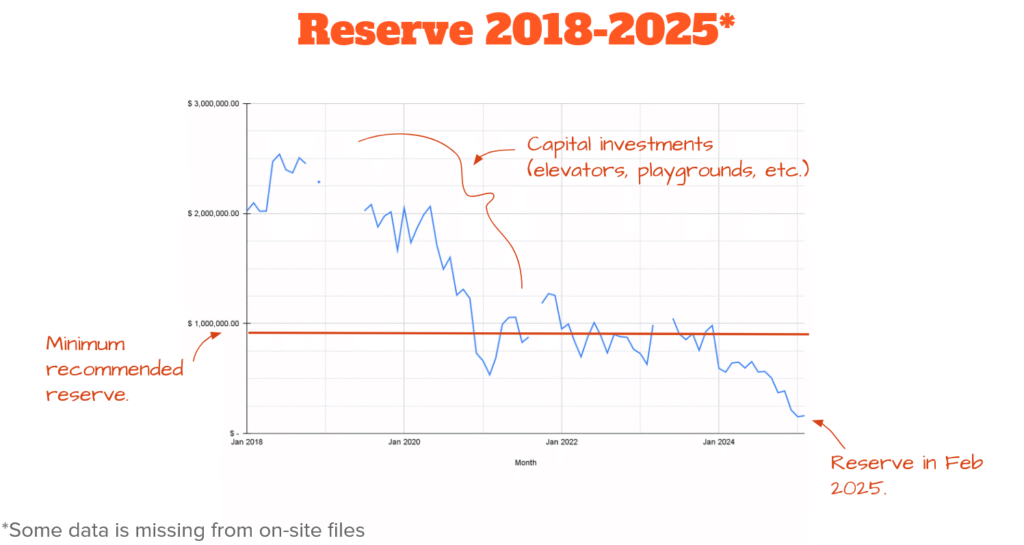

The cooperative would have to use money from its savings (reserve) to make up for money not collected with a smaller maintenance increase, and after years of previous directors spending down the reserves in exactly this way, the cooperative does not have enough in reserve to cover the current projected deficit.

In theory, it can be good policy for a cooperative to blunt the impact of rising costs on shareholders by using some reserve funds to temporarily offset operating deficits. However, the financial reality is the cooperative simply cannot do it this time.

The chart below shows the reserve from Jan. 2018 to Feb. 2025. The trend is clear, and so is the fact that the cooperative now has dangerously little in its reserve fund.

Why is there an operating assessment?

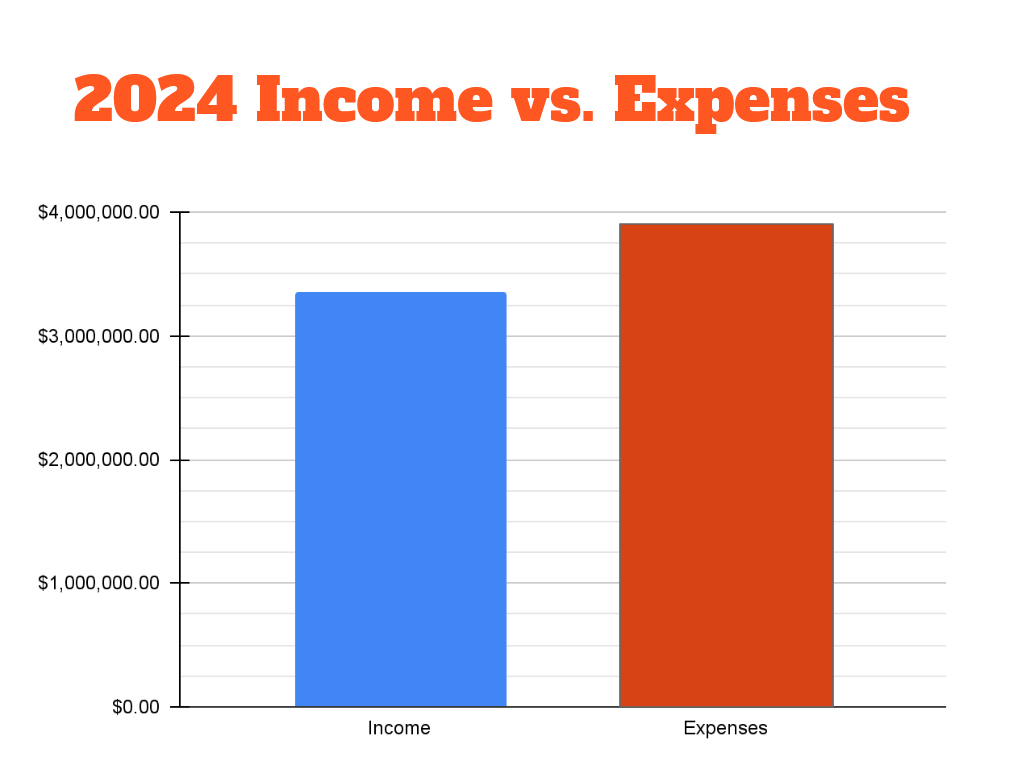

The operating assessment pays for roughly $173,000 in unpaid bills left from 2024. It corrects the fact that costs were underestimated in the budget by former directors and the fact that the reserve that might have been used to pay them were already depleted.

The chart below shows the cooperative had less income than expenses in 2024, and the result is unpaid bills.

The assessment divides the total dollar amount of unpaid bills by the number of shares in the cooperative, to arrive at a cost per share of $2.47, to be paid in seven monthly installments.

To calculate your monthly assessment payment, multiply the number of shares you own by 2.47, and divide by 7.

Example:

252 shares × $2.47 per share ÷ 7 monthly payments = $88.92 per month

Will there be a maintenance increase or assessment in 2026?

Yes, there will be both a maintenance increase and a reserve assessment.

Based on inflation projections, the board has already approved a 2% maintenance increase in 2026 to balance the budget.

Additionally, the board approved a $350,000 reserve assessment. This money will directly go to the cooperative’s emergency reserves and help pay for future capital investments, such as upgraded boilers.

As of April 2025, the cooperative has only about $200,000 in reserve, but most experts suggest a cooperative of our size should have at least $900,000 in reserve–more if capital investments are to be made.

The 2026 operating assessment will not be enough to get the cooperative to the suggested reserve minimum, so the current directors are also looking to build the reserve in other ways.

What information was shared at the Budget Meeting on April 15, 2025?

The slideshow below was shared with everyone who attended the budget meeting town hall on April 15.